Gold Credit Card

Credit Cards: A Four-Party System for Your Security

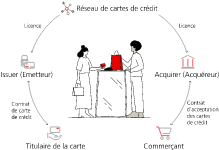

In world, credit card systems are primarily organized into four parts:

As independent companies, card issuers (issuers) and card service providers (acquirers) are responsible for connecting their customers (cardholders and merchants) to the credit card network. To do this, both issuers and acquirers must be licensed.

Every day, billions of consumers around the world purchase goods and services with credit cards in over 160 currencies and at 100 million different points of sale. Credit card companies play a very important role here.

In Switzerland, Mastercard and Visa are probably the best-known and most widely accepted credit card companies. They act as a link between the card issuer and the merchant. They ensure that the latter receives its money. You can use Visa and Mastercard credit cards in most Swiss businesses that accept cashless payments.

The four-party system is relatively complex and operates according to clear rules. The payment process of the four-party system also incorporates various measures that ensure the security of credit card payments. In addition to entering your PIN, authentication (identity verification/3-D Secure/CVC security code) is an effective security measure. Last but not least, systemic risk is equally distributed among the various stakeholders involved, rather than weighing on a single one.

Prepaid cards also offer high security standards. In the event of misuse, your risk of loss is limited to the available balance. However, if you have complied with due diligence requirements and reported any anomalies through official channels within the specified timeframe, the amount will be refunded. It's no wonder they're so popular with consumers: by 2025, more than three million cards will be in circulation.

The Payment Process: From Card Contact to Receipt

Whether it's at the bakery, the shopping mall, the sausage stand, the luxury boutique, or the circus ticket office, you can now make almost all your purchases cashless with your credit, prepaid, or debit card.

Simply hold your credit card against the terminal, enter your PIN code for the amount, press "OK," and your purchase is complete in just a few simple steps. For you, paying cashless is as simple as cash. However, a lot happens behind the scenes at credit unions.

1. Payment Process

Imagine you're shopping at the local grocery store. At the checkout, you pay contactlessly with your card, either physical or virtual via a wallet, or you use the card reader to complete the payment.

2. Payment Processing

The village grocery store's terminal forwards the transaction request to the card service provider (acquirer) with whom it has concluded its credit card agreement.

3. Credit Card Verification

The acquiring request is forwarded to the card issuer (or issuer). For example, UBS is one of the Swiss issuers. As such, UBS issues your credit card, provides you with the corresponding credit, and allows you to access the card system. The card issuers also check whether your card is blocked and whether the transaction amount exceeds your credit limit.

4. Transaction Feedback

If everything is in order, this information is sent back to the card service provider.

5. Payment Confirmation

The green light is then given to the store's payment terminal. The payment is then processed, and your receipt is printed upon request. This process only takes a few seconds.

6. Transaction Booking

The amount is immediately frozen and then deferred to your credit card account by the card issuer. The transaction is thus visible online as quickly as possible.

Customer Data Protection

Your data is processed in accordance with the provisions of the Swiss Federal Data Protection Act. Your data is used only as described in the General Terms and Conditions of Use for GCHB Credit Cards and the GCHB Privacy Policy.

In Switzerland, the financial sector goes even further: banking secrecy also applies to the handling of bank customer data. In addition, the Payment Card Industry Data Security Standard (PCI-DSS), which regulates credit card networks, establishes additional rules.

Cost Allocation

When you make purchases with your credit card, you benefit from a zero-interest loan provided you meet the payment deadline. However, every credit card purchase incurs costs within the four-party system.

Costs borne by cardholders

Annual fees are charged by the card issuer (e.g., GCHB. These vary from one issuer to another.

Transaction costs include surcharges for foreign currency transactions, fees for cash withdrawals, fees for sending paper invoices, and interest on bills you have paid in installments or for which you are late. The costs you bear vary depending on the payment card. For example, the annual fee for the GCHB Classic Credit Card is waived when it is combined with the GCHB me banking package.

Commerce

The business (in the example mentioned above, the grocery store in your village) pays the so-called merchant commission on each transaction. Typically, it is charged as a percentage (or per mille) of the transaction amount. Merchant fees apply not only to credit cards, but also to prepaid and debit cards.

Card Issuer

The merchant fee mentioned above consists of the interchange fee (interbank fee) and the service fee. The interchange fee is credited to card issuers, while the service fee is paid to card service providers.

The interchange fee serves as a financial compensation instrument, necessary in the four-party system of the credit card network. It allows for the appropriate distribution of costs and benefits among all parties involved in the credit card system (cardholders, issuers, service providers, merchants).

Conclusion

Cashless payments have become essential in everyday life. Although, as a credit card holder, paying may seem simple at first glance, each transaction involves a complex process. The credit card network is based on the so-called four-party system, which contributes, among other things, to increased payment security. This security is also ensured by Swiss data protection and banking secrecy, as well as other regulatory provisions governing credit card networks.